Starting a Proprietary Trading Firm

The world of finance is constantly evolving, and with the advent of digital platforms and advanced trading technologies, many aspiring traders are considering the establishment of their own proprietary trading firms. This guide will provide you with invaluable insights and expert advice on starting a proprietary trading firm, ensuring that you are well-equipped to embark on this exciting venture.

What is a Proprietary Trading Firm?

A proprietary trading firm, often referred to as a prop trading firm, is a business entity that engages in trading financial instruments by using the firm's own capital. Unlike traditional investment firms that invest client funds and earn commissions, proprietary trading firms operate solely on their own capital and share the profits with traders or employees.

Why Start a Proprietary Trading Firm?

Establishing a proprietary trading firm can offer multiple advantages for experienced traders:

- Control Over Trading Strategies: As the owner, you have the freedom to develop and implement trading strategies that align with your vision.

- Profit Potential: Unlike working for a salary, the potential for making significant profits is higher when you trade with your own capital.

- Flexibility: You can adapt trading styles, explore diverse markets, and innovate strategies without external constraints.

Steps to Starting a Proprietary Trading Firm

Step 1: Conduct Thorough Market Research

Before diving into starting a proprietary trading firm, it’s critical to perform comprehensive market research. Analyze market trends, study successful firms, and understand the competitive landscape. Key considerations include:

- Target Markets

- Market Regulations

- Potential Risks and Challenges

Step 2: Create a Business Plan

A well-crafted business plan serves as the foundation for your proprietary trading firm. This document should outline:

- Your business model and objectives

- Operational plans including compliance and risk management

- Financial projections and funding requirements

Ensure to include detailed information on how you plan to acquire trading capital, either through personal funds or external investors.

Step 3: Choose a Trading Structure

Deciding on the right structure for your proprietary trading firm is essential. You can choose between:

- Sole Proprietorship: Simple and easy to manage but offers no personal liability protection.

- Limited Liability Company (LLC): Allows for liability protection and flexible tax options.

- Corporation: More complex but provides stronger protection and the ability to attract investors.

Each structure has its pros and cons, so consult with a legal or financial advisor to determine the best fit.

Step 4: Secure Capital

The lifeblood of any trading firm is its capital. To operate effectively, you need sufficient trading capital. Consider the following avenues for securing funds:

- Personal Savings

- Loans from Financial Institutions

- Investments from Family and Friends

- External Investors or Partners

Transparency in how the funds will be used can build trust with potential investors.

Step 5: Obtain the Necessary Licenses and Certifications

Starting a proprietary trading firm requires compliance with various regulatory standards. Depending on your location, you may need specific licenses. Common requirements include:

- Registered Investment Adviser (RIA) license

- Broker-Dealer registration

- FinCEN registration for anti-money laundering compliance

Ensure you fully understand the compliance landscape and seek legal guidance if necessary.

Step 6: Develop Robust Trading Strategies

The success of your firm will largely depend on the effectiveness of your trading strategies. Investing in education, backtesting your strategies, and staying updated with market trends will help you refine your approach. Consider:

- Using algorithmic trading to enhance decision-making

- Incorporating risk management techniques

- Developing a diversified trading portfolio

Step 7: Set Up Operational Infrastructure

Your operational setup is crucial for seamless trading. This includes:

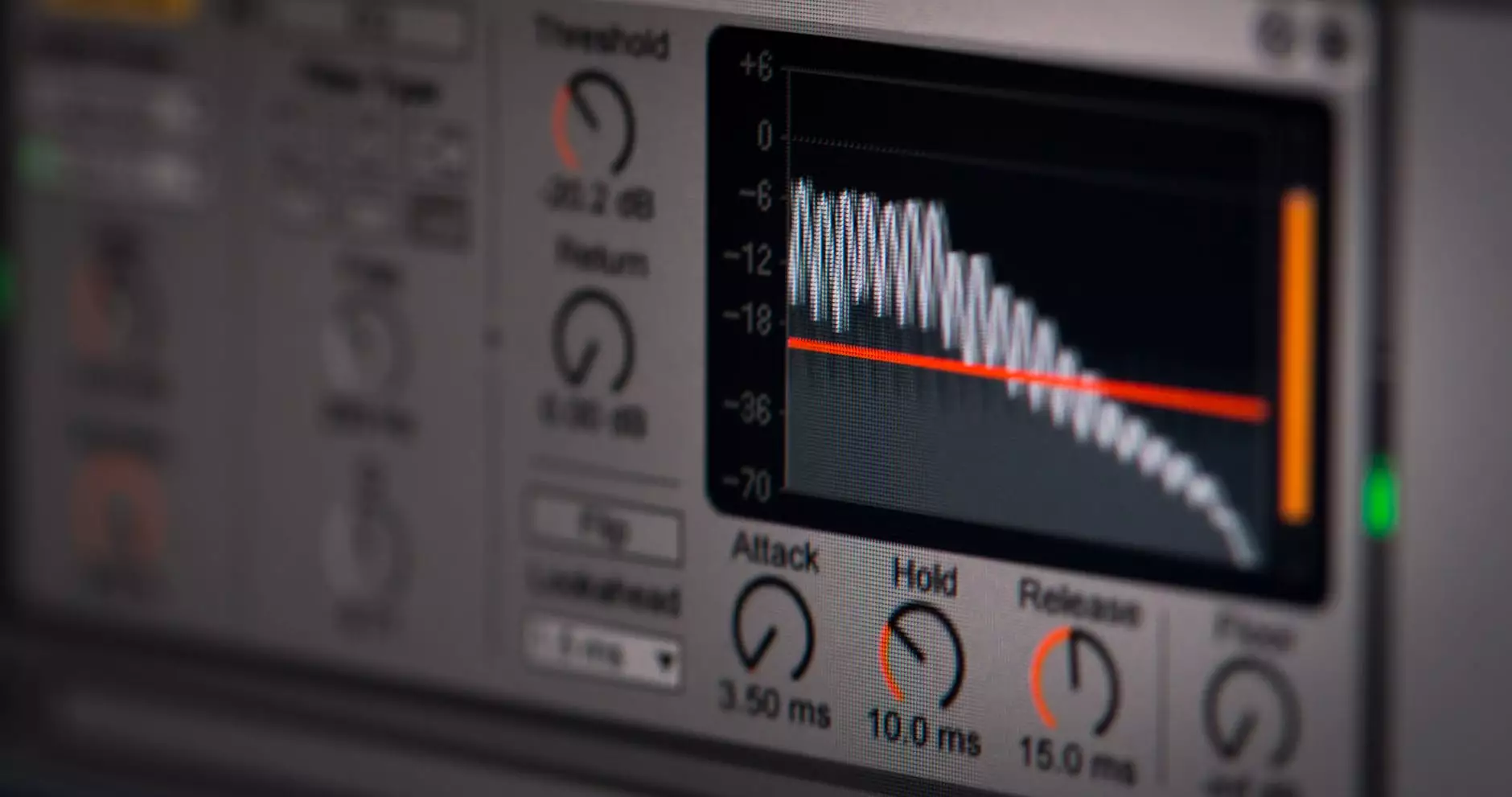

- Trading Platforms: Choose a reliable trading platform with fast execution speeds and low latency.

- Risk Management Tools: Implement tools to analyze and mitigate risk effectively.

- Data Analysis Software: Utilize advanced analytics to inform your trading decisions.

Step 8: Build Your Team

As your firm grows, you may need to hire traders, analysts, and support staff. Focus on recruiting individuals who are skilled, experienced, and align with your trading philosophy. Creating a strong team can foster a collaborative and innovative trading environment.

Challenges in Starting a Proprietary Trading Firm

While the prospect of starting a proprietary trading firm is exciting, it comes with its own set of challenges:

- Market Volatility: Financial markets are unpredictable, which can result in significant losses if not properly managed.

- Regulatory Changes: Stay vigilant about changes in financial regulations that could impact your operations.

- Competition: The proprietary trading space is highly competitive; differentiating your firm is critical.

Best Practices for Running a Successful Proprietary Trading Firm

To thrive in the competitive financial landscape, consider these best practices:

- Continuous Education: The finance sector is constantly changing; invest in ongoing training for yourself and your team.

- Networking: Build relationships within the industry to share insights and collaborate.

- Technology Investment: Leverage technology to improve trading efficiency and gain a competitive edge.

Conclusion

Starting a proprietary trading firm is a challenging but rewarding endeavor that can provide significant financial opportunities. Armed with the right knowledge, a solid financial plan, and a committed team, you can navigate the complexities of the financial markets. Remember, the key to success in this business is not only in the strategies you use but also in your ability to adapt and innovate in an ever-changing landscape. For more insights and resources on starting a proprietary trading firm, visit propaccount.com.