The Essential Role of a Bookkeeping Services Company

In today's fast-paced business world, accurate financial management is more crucial than ever. As a business owner, you might find that the complexities of financial reporting, payroll management, and tax compliance can become overwhelming. This is where a bookkeeping services company can make a significant impact. In this article, we'll explore the various facets of bookkeeping services and how they can contribute to your business's success.

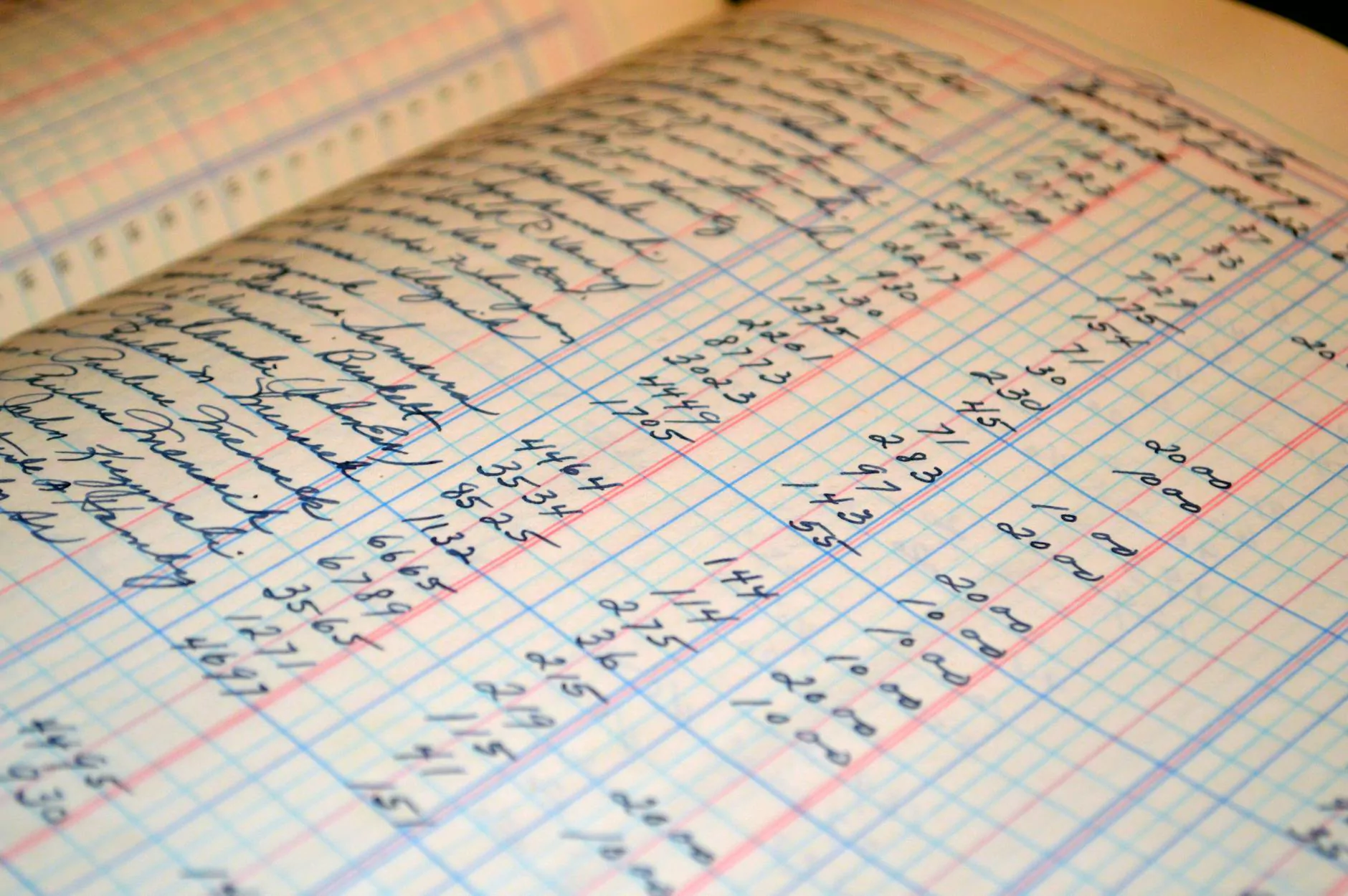

What Are Bookkeeping Services?

Bookkeeping services encompass a range of activities aimed at recording, storing, and retrieving financial transactions for a business. The primary objective is to maintain thorough and accurate financial records that provide valuable insights into the company's performance. These services typically include:

- Transaction Record Keeping: Maintaining a detailed account of all financial transactions.

- Accounts Payable and Receivable: Managing money that is owed to the business and debts that need to be settled.

- Bank Reconciliation: Ensuring that the company’s records align with bank statements to catch discrepancies.

- Payroll Processing: Handling employee compensation, including wages, bonuses, and deductions.

- Financial Reporting: Providing reports that aid in strategic decision-making.

- Tax Preparations: Facilitating the preparation and filing of tax returns to ensure compliance.

Why Choose a Professional Bookkeeping Services Company?

Investing in a professional bookkeeping services company can yield significant advantages for your business:

1. Expertise and Accuracy

Many business owners are not trained in financial management. Choosing the right property will ensure that a team of experts handles your financial data. Professionals are more likely to produce accurate records and reports, minimizing errors that could lead to legal complications or financial losses.

2. Time-Saving

By outsourcing your bookkeeping needs, you can dedicate more time to focusing on your core business activities. This can lead to increased productivity and potentially higher revenue, as you will not be bogged down by tedious financial tasks.

3. Enhanced Financial Analysis

Bookkeepers can provide insights derived from financial data, enabling better decision-making. With detailed reports on income, expenditure, profit margins, and more, a bookkeeping services company will help you understand your financial position clearly.

4. Improved Cash Flow Management

Proper bookkeeping practices can help you manage your cash flow more effectively, highlighting when money is coming in and going out. This ensures that you maintain sufficient liquidity to cover operational costs at all times.

5. Scalable Solutions

As your business grows, your bookkeeping needs may change. Utilizing a professional service allows for scalability, where you can upsize or downsize the services you require depending on your business situation.

How to Choose the Right Bookkeeping Services Company

Selecting a bookkeeping services company is not a task to be taken lightly. Here are key factors to consider:

1. Reputation

Look for reviews and testimonials from other clients. A reputable company will have proven success in helping businesses similar to yours.

2. Services Offered

Ensure the company offers a comprehensive suite of bookkeeping services, including payroll, reporting, and tax preparation, as per your requirements.

3. Experience

Experience matters in bookkeeping. Look for firms with proven track records and seasoned professionals who have dealt with various financial scenarios.

4. Technology Utilization

Inquire about the tools and software the company uses for bookkeeping. Modern technology can enhance efficiency and accuracy.

5. Cost Structure

Compare pricing models among various service providers to find one that suits your budget while also ensuring quality service.

Key Benefits of Outsourced Bookkeeping

Outsourcing your bookkeeping has become a preferred choice for many organizations. Below are some of the significant benefits:

1. Cost Efficiency

Hiring in-house staff can be costly, considering salaries, training, and benefits. An outsourcing solution means that you only pay for services as needed, making it a more cost-effective approach.

2. Risk Management

Outsourcing reduces the risk of financial discrepancies—for example, errors in tax filings can incur penalties. Professionals are well-versed in laws and regulations, minimizing the risk of compliance-related issues.

3. Objectivity

External bookkeepers provide an unbiased perspective on your finances. They can highlight areas of concern you might overlook and offer invaluable insights into improving your financial health.

4. Focus on Growth

By handing off financial responsibilities to a bookkeeping services company, you empower your team to pursue growth opportunities instead of being bogged down by financial administrative tasks.

Conclusion: Partnering with BookSLA for Your Bookkeeping Needs

As a business owner, effective financial management is the backbone of your organization. Choosing the right bookkeeping services company, like BookSLA, ensures that your financial records are meticulously maintained, freeing you to focus on growth and strategic planning.

With expertise spanning across various sectors in financial services, financial advising, and accounting, BookSLA offers tailored solutions designed for businesses of all sizes. Our commitment to excellence, combined with cutting-edge technology and a client-centric approach, makes us the partner you need to thrive in a competitive landscape.

Get Started Today!

Contact us now to learn how our bookkeeping services can help streamline your financial operations and set your business on a path to success. Don't leave your financial future to chance—partner with BookSLA and experience the difference!